OMCO 在印第安纳州的制造工厂的项目案例,它的工作场地有很大的斜坡,中间有一个很深的洼地。“我们相应地设计了立柱高度和嵌入,我们也可以在客户网站上这样做,”凯斯勒说。

太阳能行业一个可笑的情况:太阳能跟踪器成为地面安装太阳能项目的首选方法,就在我们用完平坦的土地时,斜坡、起伏的地形和岩石景观已经成为现在的常态。这些条件给任何地面安装项目带来了工程和成本挑战,尤其是对于跟踪器。

OMCO Solar太阳能技术总监马特·凯斯勒 (Matt Kesler) 表示:“就在几年前,答案是‘移土’ ,因为场地平整使跟踪器安装变得更加容易。但由于一些原因,这种情况发生了变化。随着数量的增加,太阳能组件、跟踪器和其他所有东西的成本已经下降,这通常使得对场地进行分级分类的成本不再可接受。此外,RFP(项目招标书)开始将其排除在外,因为更好的土地管理是公用事业和市政当局的更大优先事项。

“客户说选址变得更具挑战性。有些人试图减少分级或根本不分级。通过简化雨水管理和为项目现场带来生态系统效益,这使得许可变得更加容易,” Sunfolding业务发展副总裁 Ryan Kelly 说。

我们与三个太阳能跟踪器制造商讨论了他们如何克服不规则场地挑战,同时解决其他新出现的障碍,例如大尺寸组件、钢材价格等。

间隔布局

问题不是真的,“我们可以在那个站点安装太阳能跟踪器吗?” 问题是您希望该解决方案有多昂贵或多复杂。

对不平坦、起伏不平的场地进行分级是一项相当大的费用,尤其是在劳动力成本较高的东北部。为了避免这些,跟踪器通过混合堆高来提高其波动容差,通常增加钢和增加结构力和/或使用更短的行。

FTC Solar的性能工程总监 Benjamin Kahane 说:“对于波浪地形上的项目,我们增加了波动容限以增加允许的桩高,最多可达 3 英尺左右。” “你可以让追踪器的一侧高出 10 英尺,而另一侧高出 7 英尺。”

混合不同桩高时要考虑的其他随机成本:更高的起伏容差可能意味着安装人员需要更多的梯子工作和更多的工程时间。避免场地分级所节省的部分成本可能会因钢材价格的上涨而损失,但 Kahane 表示“在分级成本节省方面,这比它自己付出的要多。”

如果客户想要获得额外的布局,这些钢铁成本可以进一步降低。Kahane 向我展示了他们今年为一位客户设计的复杂电站,其中有十几个不同的颜色编码部分,并注明了不同的最大/最小高度和嵌入深度。

复杂的 FTC Solar 站点示例。

“这需要大量的尽职调查,但定制的嵌入深度将为他们节省钢材成本,”他说。“我们可以说只是将它们全部嵌入到 10.5 英尺,因为这是最需要的深度,但该客户正在寻求额外的成本节约,因此我们变得更加复杂。”

设计调整还不止于此。由于跟踪器制造商为每个站点定制设计布局,他们还整合了设计调整以适应大规格组件。FTC 的 Voyager Plus就是一个例子:电机更大一些,扭矩管更坚固,导轨更长更厚,阻尼器数量增加。

在节省钢材上下功夫

但是这个成本方程是一个移动目标。自从我们和 Kahane 聊天以来,钢铁价格上涨得更多,供应链问题总体上变得更糟,而不是更好。

“当然,钢铁成本令人担忧,” OMCO Solar业务发展总监 Eric Goodwin 说。“去年这个时候,5MW级别跟踪器项目的成本是 17 美分,而现在它们的价格在 31 到 33 美分之间。”

OMCO的核心是一家钢铁公司,因此在这方面确实具有优势。“我们已经能够将我们的钢材定价比竞争对手低 18% – 20%,将这些节省的成本转嫁给我们的合作伙伴,并最终转嫁给最终客户,”古德温指出。“我们对客户非常透明——向他们展示钢铁指数,这样我们就可以向他们展示为什么会发生这种情况。我们在利润率方面也更具战略性,因此我们可以为客户提供绝对最优惠的价格。”

在国内而非海外采购钢材也有助于避免与运输延误和运费成本相关的问题。这可能是 6 到 8 周的提前期和 20 到 24 周之间的差异。“我们的国内制造能力意味着我们可以在几周内——有时甚至是几天内——扭转局面,而且我们有更多的机会进行微调,”凯斯勒说。“我们有内部结构工程,所以我们可以改变我们制造的每个太阳能结构的长度和横截面尺寸。”

OMCO Origin Factory-Direct Tracker以两种方式提供:

1) 单面组件的优化设计,例如,包括 First Solar 6 系列的薄膜组件。

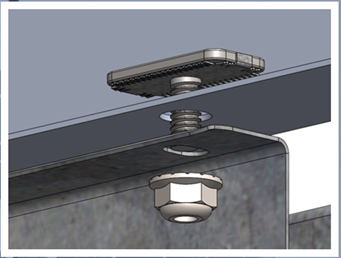

2) 用于双面组件的二合一横向单轴跟踪器。由于立柱高度和跟踪精度如此重要,跟踪器系统还需要一点回旋余地和可调节性。例如,OMCO Solar 的轴承允许高度调整以补偿有缺陷的柱高度。

“我们通常建议加长跟踪器——我们可以提供多达 120 个组件的跟踪器——因为这降低了跟踪器的成本、安装成本和 O&M 成本——每兆瓦减少了电机和控制器,”凯斯勒说。

到目前为止,OMCO 的重点是 10MW和招标项目市场,但古德温表示,他们将认真研究公用事业规模市场,“打算在 2022 年中期开始项目。”

无电机

公用事业规模的电站成本和风险在提高。根据美国能源信息署在 2020 年 2 月的一份报告中,一个 150MW太阳能项目的土木和结构工程的估计成本为每瓦 5.3 美分。包括起重机和脚手架在内的间接成本估计为每瓦 1.4 美分。这些项目,不包括建筑人工和后期材料,在项目总成本中占了 1000 万美元。成本可能会因现场条件而有很大差异。

Sunfolding 的团队指出,在较短的跟踪器行跨度的额外费用与来自挖填式挖掘和可变长度支柱的额外成本之间,还有一个权衡。这些较短的行确实会增加硬件成本,因为机电设备没有得到最佳利用。

“通过消除电机,短的跟踪器跨度(小至或低于单个字符串尺寸)可以在干扰最小的情况下适应地形。Sunfolding 产品管理总监 Bart Oegema 指出,土方工程没有额外的意外成本,也没有‘部分行’的额外成本。这篇博文深入探讨了该方案(延伸阅读)

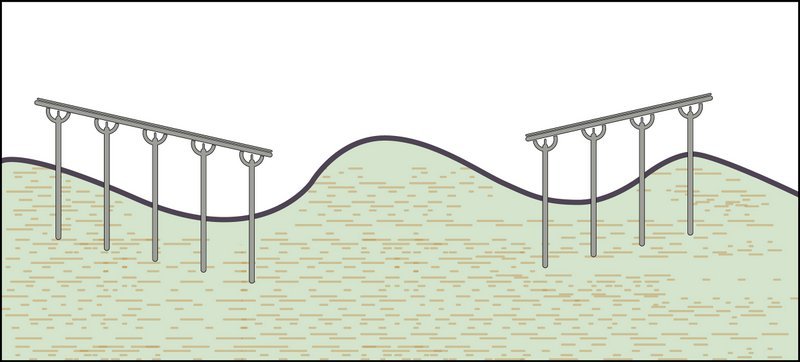

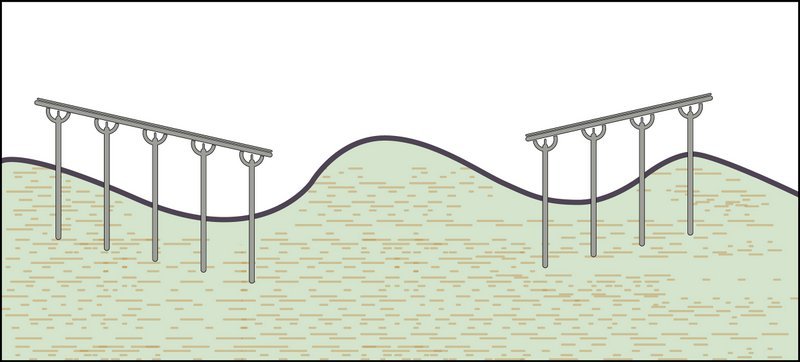

无电机跟踪器遵循中间坡度,不需要土方工程。

短跨度的无电机跟踪器可适应地形,允许阵列设计适应您的场地特征,从丘陵到沼泽,或濒临灭绝的物种的通行权。跟踪器行不再是局部的,它们只是模块化的、特定于站点的跨度。

高效的系统设计可适应起伏的地形,立柱可以保持斜坡的中间坡度和最小的嵌入要求,无需挖填。通过这种方式,无需电机的太阳能跟踪器可以部署在起伏的地形上,而不会对场地的特征或生物造成严重的破坏。

Sunfolding 的 T29实际上可以跟随陆地,并且可以部署在倾斜的地形上,单位成本与平地上的跟踪系统相同。Sunfolding 每英亩平均需要 10 立方码的土方工程(其他跟踪器在起伏的地形上每英亩可能需要平均 230 立方码的土方工程)。较短的跟踪器行允许 Sunfolding 使用单个柱长度并避免重型机械和索具的成本,以及驱动超长柱所需的额外劳动力和材料成本。

结语

“跟踪器需要适应现场,而不是让现场来适应项目,”OMCO 的凯斯勒谈到今天的期望时说。“追踪器供应商需要查看每个站点,决定他们是否可以在不分级的情况下支持它,并相应地、诚实地向客户提供建议。然后通过帮助客户实现承诺来支持他们。”

原文:

OMCO’s manufacturing plant in Indiana is a good example of a working site with a significant slope and a deep depression in the middle. “We designed post heights and embedments accordingly, and we can do that on customer sites too,” Kesler says.

A solar industry irony: solar trackers became the go-to approach for ground-mounted solar projects just as we ran out of flat land. Slopes, undulating terrain and rocky landscapes are the norm today. These conditions present engineering and cost challenges for any ground-mount project, but especially for trackers.

“Just a few years ago, the answer would have been to ‘move dirt,’ says Matt Kesler, director of solar technology for OMCO Solar, as site grading made tracker installation much easier. But this has changed for a few reasons. The cost of solar modules, trackers and everything else has come down as volumes have risen, often making the cost of grading a site no longer acceptable. Moreover, RFPs are starting to rule it out as better land stewardship is a bigger priority for utilities and municipalities.

“Customers say siting has become more of a challenge. Some are trying to get away with less grading, or no grading at all. This makes permitting easier by simplifying stormwater management and delivering ecosystem benefits to the project site,” said Sunfolding vice president of business development Ryan Kelly.

We chatted with three solar tracker manufacturers on how they are overcoming irregular site challenges – while also solving other emerging obstacles, such as large-format modules, steel prices and more.

Granular layouts

The question isn’t really, “can we install solar trackers on that site?’ The question is how expensive or complex you want that solution to be.

Grading an uneven, undulating site is a fairly significant expense, especially in the Northeast which has higher labor costs. To avoid those, trackers are boosting their undulation tolerances by mixing pile heights, usually adding steel and increasing structural forces and/or going with shorter rows.

“With projects on wavy terrain, we increase the undulation tolerance to increase the allowable pile height, up to maybe 3 feet or so,” says Benjamin Kahane, director of performance engineering with FTC Solar. “You could have one side of the tracker that’s 10 feet in the air and the other is 7.”

Other random costs to consider when mixing in various pile heights: Higher undulation tolerances can mean more ladder work for installers and more engineering time. Some of the cost savings from avoiding site grading can be lost to the increase of steel prices, but Kahane says “it more than pays for itself in grading cost savings.”

Those steel costs can be tamped down further if the customer wants to get extra granular. Kahane shows me a complex site they designed for one customer this year with a dozen different color-coded sections, noting different max/min heights and embedment depths.

“It required a ridiculous amount of due diligence, but the custom embedment depths will save them money on steel,” he says. “We could have said just embed them all to 10.5 ft because that’s the deepest it needs to be, but this customer was looking for extra costs savings, so we got more complex.”

The design tweaks don’t end there. As tracker manufacturers are custom-designing layouts for each site, they are also incorporating design tweaks to accommodate large format modules. FTC’s Voyager Plus is an example: the motors are a bit bigger, the torque tube is beefier, the rails are longer and thicker and the number of dampers increased.

Saving on steel

But this cost equation is a moving target. Since we chatted with Kahane, steel prices have increased even more, and supply chain issues in general are getting worse, not better.

“Certainly, steel costs are concerning,” says Eric Goodwin, director of business development at OMCO Solar. “Five MW tracker projects would’ve been 17 cents last year at this time, whereas now they are ranging from 31 to 33 cents.”

At its core, OMCO is a steel company, so it does have an advantage in this area. “We’ve been able to price our steel 18% – 20% less than competitors, passing those savings on to our partners, and ultimately, to the end-customers,” Goodwin notes. “We are very transparent with our customers – showing them the steel index so we can show them why this is happening. We have also been more strategic on margins so we can offer our customers the absolute best pricing we can.”

Sourcing steel domestically instead of overseas also helps avoid issues related to shipping delays and freight costs. This can be the difference between 6 to 8 weeks of lead time and 20 to 24 weeks. “Our domestic manufacturing capacity means we can turn things around in a few weeks – or sometimes even days – plus we have a lot more opportunity to fine tune,” Kesler says. “We have in-house structural engineering, so we can change both the length and the cross-sectional dimensions of every solar structure we make.”

OMCO Origin Factory-Direct Trackers are offered in two ways: 1) An optimized one-in-portrait design for monofacial modules, which includes thin film modules for First Solar’s Series 6, for example. 2) A two-in-landscape tracker for bifacial modules. With post height and driving accuracy being of such importance, tracker systems also need a little wiggle room and adjustability. OMCO Solar’s bearings for example allow height adjustment to compensate for flawed post heights.

“We usually propose long trackers – we can supply trackers up to 120 modules – because that reduces the cost of the trackers, the cost of installation, and O&M costs – fewer motors and controllers per MW,” Kesler says.

OMCO’s focus to this point has been the 10-MW and under DG market, but Goodwin says they will be seriously looking into the utility-scale market, “with the intention to begin projects in mid-2022.”

Going motor-free

Utility-scale sites heighten the stakes. According to the U.S. Energy Information Administration in a February 2020 report, the estimated cost for civil and structural work in a 150-MW solar project was 5.3 cents per Watt. The estimated indirect cost, including cranes and scaffolding, was 1.4 cents per Watt. These items, not including construction labor and post material, contribute $10 million to the project cost overall. And costs can vary considerably based on site conditions.

There’s also a tradeoff between the added expense of shorter tracker rows, and the added cost that comes from cut-and-fill excavation and variable-length posts, notes the team at Sunfolding. Those shorter rows do increase hardware costs because the electromechanical equipment isn’t being utilized optimally.

“By eliminating motors, short tracker spans (down to or below a single string size) can adapt to the terrain with minimal disturbance. No additional, surprise cost for earthwork, and no additional cost for ‘partial rows,’” notes Bart Oegema, Director of Product Management at Sunfolding. This blog post goes in-depth on that topic.

Motor-free trackers follow the median grade and don’t require earthwork.

Motor-free trackers with short span lengths work with the terrain, allowing the array design to accommodate your site’s features, from hills to swamps, or an endangered species’ right of way. Tracker rows are no longer partial, they are simply modular, site-specific spans.

An efficient system design accommodates undulating terrain with posts that can maintain both the median grade of the slope and minimum embedment requirements without cut and fill. In this way, motor-free solar trackers can be deployed on undulating terrain without extensive disruption to a site’s features or creatures.

Sunfolding’s T29 can actually follow the land and can be deployed on sloped terrain at the same unit cost as a tracker system on flat land. Sunfolding requires an average of 10 cubic yards of earthwork per acre (other trackers can require an average of 230 cubic yards of earthwork per acre on undulating terrain). Shorter tracker rows allow Sunfolding to use a single post length and avoid the cost of heavy machinery and rigging, as well as added labor and material costs, that would be required to drive extra-long posts.

Bottom line

“The trackers need to adapt to the site, not the other way around,” OMCO’s Kesler says of today’s expectations. “Tracker suppliers need to look at each site, decide if they can support it without grading, and advise customers accordingly and with integrity. Then support customers by helping them achieve what was promised.”